News

CSEAWinter2024

The Federal Pregnant Workers Fairness Act of 2023

2021-2026 UCS Contract

CSEA Judiciary unit and UCS reached a Tentative Agreement

As you may be aware, CSEA Judiciary unit and UCS reached a Tentative Agreement on November 8, 2022. Here is a side-by-side comparison between the current 2020-2021 collective bargaining agreement and the new Tentative Agreement. On November 21, 2022 CSEA will send ballots to vote on this Tentative Agreement via electronic means Election Buddy to members whose non-work email addresses are on record with CSEA; and a paper ballot and return envelope to members for whom CSEA does not have a non-work email address.

To check/correct/ or add an email address please call: 800-342-4146 or send an email informing them of a correct email address at : membersolutionscenter@CSEAINC.ORG no later than Friday, November 18, 2022.

For those members whose email addresses are on record and who will receive the Election Buddy notification, please DO NOT forward the notification you receive to another party or email address. Once the email is forwarded, and anyone else uses it, that will count as YOUR vote. Once you have voted on Election Buddy, the email will disappear, but you will receive a receipt confirming your vote. All ballots, paper and electronic, are due back to CSEA by close of business on December 21, and all ballots will be counted on December 22, 2022.

CSEA will be sending out reminder emails to vote periodically to emails which have not cast a vote. Each reminder will contain a valid ballot that you can use to vote, so you do not need to search your emails to find a ballot. Anyone who has cast a vote through Election Buddy will not receive any further reminders.

Please check back here election reminders and updates.

In Solidarity,

CSEA Local 694 Summer Picnic 2021

2 PERCENT RAISE

Please be advised that CSEA has filed with OCA a class-action grievance regarding our 2 percent salary increase. CSEA has demanded that we be paid the 2 percent increase negotiated and contained in Article 7 of the contract including retroactive amounts from April 1, 2020. We fully expect to be successful. We will update you when we have more information.

EBF ENHANCEMENTS

Another reminder that effective January 1, 2020, the new maximum benefit for the combined co-pay reimbursement is now $350, an increase from previous years. You will also now be able to include charges for prescriptions that are less than your co-pay amount, prescription drugs that are not covered under your plan and brand name/generic differentials. Your physician office visit co-pays now include any “out of pocket” charges as well. UCS Retirees will now have the same combined co-pay benefit as the Full-time active employees.

Another additional benefit effective July 1, 2020, EBF Dental and Vision will be extended to dependent children up to age 26. The EBF will no longer require dependent children over the age of 19 to be full-time college students in order to receive benefits. That means, no more burdensome student proof documents will be required.

Step children are now eligible to receive benefits regardless of whether they are living with our members or not.

EBF has extended this coverage to dependent children under the age of 26 regardless of marital status. A dependent who was previously married may now be eligible for EBF benefits again effective July 1, 2020.

Any dependent removed due to the prior guidelines, or those who may never have been added previously because they did not meet the prior requirements, are eligible to be added to the EBF effective July 1, 2020.

Any dependent who was eligible as of July 1, 2020, and already on file, will automatically stay covered until they turn 26.

PLEASE NOTE: Reinstatements will not be automatic. The EBF will require an updated Enrollment Form to either reactivate eligible dependents or to add newly eligible dependents. You may access your EBF personal file through the Member Portal on their website, CSEA Employee Benefit Fund The portal is easy to use and allows you to quickly review who is currently eligible and enroll those who are now eligible for this benefit upgrade.

We are so proud to be able to offer these enhancements. This is just another example of your dues money working for your benefit. It is a way to say thank you for remaining a union member and keeping our union robust, strong and healthy.

Be sure to check out all of your EBF Benefits including reimbursements.

Thank you and stay well!

From your executive team:

Nicole Ventresca-Cohen-President

518-432-3417

Dawn Cota-1st Vice President

518-285-8232

Brian Wilson-2nd Vice President

518-432-3454

David Chambers-Secretary

518-432-3919

Joseph Graziano-Treasurer

518-432-3451

CSEA Local 694 Scholarship Application 2020 extension

Hello CSEA Local 694 Members,

As many of us are transitioning back to in-person operations at our respective work locations and others are still working in the virtual world, I do hope that things are going as smoothly as possible. I wanted to reach out and remind you that if you are having any issues or have any questions, please do not hesitate to reach out to one of your local officers to see if we may assist you. We have been doing safety assessments of our locations and to the extent possible making site visits, as well as going over staffing plans, to ensure that the workplace is as safe and healthy as can be for our members. I am happy to report that management has been working very well with the union and listening to our suggestions.

As it is not feasible at this time to schedule a local membership meeting, we did not want to postpone any longer the scholarship award program that we have been able to do in our local for many years. To that end, we are extending the deadline for scholarship applications to be submitted. The new deadline is now June 26, 2020. We will then select the winners on June 30, 2020 and notify all winners by email. Good luck to those applying.

We will see how everything progresses and when we can find some sort of constant, we will try to set up a membership meeting hopefully sometime in the Fall. If we cannot do it in person, we will look at a way to possibly have a “virtual” membership meeting. In the meantime, we will continue to send out blast emails on any information that is important for you to know.

One last item, if you know of a co-worker who is a member of our local not receiving our emails but would like to, please have them contact one of us so that we may add them to our list.

Thank you again for all you have been doing and we hope your families are all staying healthy.

CSEA Local 694 Scholarship Application 2020

CSEA Scholarship opportunities

CSEA SCHOLARSHIP OPPORTUNITIES

CSEA announces the 2020 Irving Flaumenbaum Memorial Scholarship Program.

High school seniors who apply for the Flaumenbaum Scholarship are automatically in the running for the

Pearl Insurance and MetLife Insurance Company Scholarships.

For additional information and application:

Irving Flaumenbaum Memorial Scholarship

From your executive team:

Nicole Ventresca-Cohen-President

518-432-3417

Dawn Cota-1st Vice President

518-285-8232

Brian Wilson-2nd Vice President

518-432-3454

David Chambers-Secretary

518-432-3919

Joseph Graziano-Treasurer

518-432-3451

Judiciary Members Overwhelmingly Ratify Contract Extension

(Susan Radosh, CSEA Dep. Director of State Operations, July 29, 2019)

CSEA Judiciary members across the state overwhelmingly ratified a one-year contract extension with the Unified Court System. The contract extension runs from April 1, 2020 through March 31, 2021. Extension highlights include annual salary schedule increase for all employees in the unit, increases to longevity payments, location pay increases, Security and Law Enforcement Differential (SLED) payment increases and an increase in Family Sick Leave, line of duty leave, bereavement leave, increased contribution to the Employee Benefit Fund and more. (See the link below for Highlight Sheet)

UCS CANCER SCREENING POLICY – REVISED

(Kathy Guild, CSEA Dep. Director of Contract Administration, March 19, 2018)

CSEA recently received new Cancer Screening Policy language from OCA (see below). In addition to the information provided, please note that the Cancer Screening Leave must be pre-approved and employees must provide documentation to substantiate their absence for cancer screening upon return to work.

“Currently, Civil Service Law provides for 4 hours of paid leave, without charge to leave credits, for New York State employees to undergo breast and/or prostate cancer screenings. Effective March 18, 2018, the specific references in the law to ‘breast’ and ‘prostate’ are replaced with ‘cancer’ screening, generally.

“This change in law broadens the scope of the existing Court System leave benefit by covering all cancer screenings. The Court System will continue to provide employees with up to 4 hours of paid leave to undergo screening for breast and/or prostate cancer. This means that employees will be entitled to up to 12 hours of paid leave annually to undergo cancer screenings – 4 hours for breast cancer, 4 hours for prostate cancer and 4 hours for any other type(s) of cancer. Part-time employees are also entitled to 4 hours of paid leave for each type of screening. Travel time is included in the 4 hours. Any absence beyond the 4-hour maximum must be charged to the employee’s leave credits.

“Leave for cancer screenings is provided on an annual basis and does not carry over from one calendar year to the next. However, the 4 hours may be used all at once or in increments over the course of the year. For example, if an employee uses 2 hours of paid leave to undergo breast cancer screening and the employee’s doctor requires the employee to undergo further screening/testing in the same year, the employee is entitled to 2 more hours of paid leave for this purpose. Employees who undergo cancer screenings outside their regular work hours do so on their own time and are not entitled to receive compensatory time.

You and your family members are eligible to earn a free – yes, free – two-year degree through AFSCME. This program is continually changing and updating, with more online degrees being offered. See the attached flyer for further information and eligibility requirements.

Longevity and Percentage increases

(Kathy Guild, CSEA Dep. Director of Contract Admin., March 15, 2018)

The 2018 n egotiated 2% pay increases will be paid out beginning in the May 2nd, 2018 paycheck. Those eligible for Longevity Payments will also see that payment reflected in the May 2nd paycheck.

MEMBER Only Benefit – Shopping Discounts

The CSEA executive branch contract was overwhelmingly ratified with a 94 percent yes vote on August 8th.

Judiciary employees are covered by the health insurance negotiated by the executive branch. The health insurance changes will go into effect 1/1/19 are posted on the judiciary website at www.cseajudiciary.org for your perusal.

***************************************

Correction: DATE Change

The 2 percent raise effective 4/1/17 will be retroactively paid in the 10/4/17 paycheck.

PAYCHECK/TAX INFORMATION: Paycheck date: October 4, 2017 Taxes: The retroactive raises will be included in your regular paycheck. The retroactive payments are considered supplemental wages and will be taxed using the Supplemental Aggregate Method. Employees wishing to change their tax exemptions must submit completed tax forms between the dates of August 10 – August 23, for their 9/6 paycheck to be affected. Tax Forms are available on DFM’s webpage: https://www.irs.gov/pub/irs-pdf/fw4.pdf Forms may be sent to payroll@nycourts.gov

2017-2020 CSEA-UCS Contract Ratifies

(Kathy Guild, Dep. Director of Contract Administration, July 24, 2017)

The CSEA-UCS contract was overwhelmingly ratified today by an 8 to 1 ratio, with a total of approximately 50% turnout. There were 2,122 yes votes (88%) and 285 no votes (12%). Your CSEA Negotiating team thanks you for the tremendous voter response and are grateful that the proposed contract was well received. The terms of the contract are effective immediately.

Update on taxation of State Supplemental Payments – Tuesday, June 13, 2017

The New York state comptroller’s office was recently informed of an Internal Revenue Service ruling which requires Supplemental wage payments including longevity payments, call out bonus, tool allowance, hazardous duty pay, back pay, retroactive wage increases, awards, uniform allowance, unused vacation accruals lump sum, salary deferral lump sum, standby, intermittent inconvenience, step 3 out-of-title grievance payments, and any other payment that is above regular wages, to be processed with a higher withholding rate than regular wages.

Under the regulations, employers have the option to withhold a flat rate of 25% on supplemental wages or use a more complex aggregate method for calculating the withholding that combines regular and supplemental wages according to what you entered on your W-4 for withholding allowances and additional withholding amounts.

To be in full compliance with these IRS rules, the State’s Comptroller’s Office initially determined to use the flat rate 25% method, starting with the April 2017 Longevity Payments. In response to strong objections by CSEA, and after further research by CSEA, the state comptroller has determined that the aggregate method will be used to determine the proper amount of withholding to be taken out of supplemental payments. This method is more beneficial to our members than using the flat 25% rate. However, even with the aggregate method, the withholding will still be significantly more than what has been withheld in the past.

It is important to note that regardless of the tax withholding method used on supplemental payments, an individual’s tax liability is the same at the end of the year. Taxes withheld over and above what a person owes will be refunded when you file your tax returns.

In the meantime an individual can always change their withholding amounts and their claimed withholding allowances on their W-4 prior to the supplemental payments in order to realize more money in the supplemental check. An individual can change their withholding amounts and their withholding allowances as many times as they desire throughout the year in order to capture more money in any supplemental check.

If you have any questions please contact State Operations at (518) 257-1213.

Mary E. Sullivan, Acting President

CSEA REACHES TENTATIVE AGREEMENT WITH THE NYS OFFICE OF COURT ADMINISTRATION

(Kathy Guild, CSEA Dep. Director of Contract Administration, May 17, 2017)

CSEA has reached a tentative agreement with the New York State Office of Court Administration on a new contract covering more than 5,500 non-judicial employees in the state’s Unified Court System. The tentative agreement will be effective retroactively from April 1, 2017 through March 31, 2020.

CSEA and the Unified Court System have reached a fair and responsible agreement that recognizes the value and importance of the court employees who make the system work every day.

The three-year agreement retroactive to April 1, 2017 includes salary increases in every year of the agreement, improved downstate and Mid-Hudson Valley location pay, improved payments to the Employee Benefit Fund and a new Welfare Fund program.

Across-the-board cost of living adjustments are as follows: April 1, 2017 – 2 percent(retroactive); April 1, 2018 – 2 percent; and April 1, 2019 – 2 percent.

Additional details about the agreement will be posted shortly on the CSEA Judiciary website, www.cseajudiciary.org, and the CSEA website, www.csealocal1000.org. The agreement will be presented to the CSEA rank and file members for review and ratification in the weeks ahead. It must also be approved by the state legislature and signed by the governor.

A Contract RATIFICATION and highlight meeting is being scheduled and details will be sent soon.

***********************************************************************

Very important information, please share with co-workers and watch for updates as to what CSEA is doing regarding this change at http://www.cseany.org.

As you will see below, there was and will be a substantial increase in the taxes taken out of the signing bonus, uniform and equipment allowance, and the longevity payments.

STATE OF NEW YORK

OFFICE OF THE STATE COMPTROLLER

Tax withholding for recent Longevity Payments

OSC changed the income tax withholding methodology for all supplemental wages to be in compliance with Internal Revenue Service requirements. Supplemental wages, which include longevity payments, are typically one-time or once a year payments and are not considered regular wages.

Income taxes for supplemental wages are withheld at a Supplemental Flat Rate (Federal 25% and State 9.62%). Under this method, withholding allowances claimed by the employee are disregarded. The flat tax method does not change what you will owe in income taxes for the tax year. Also, taxes withheld over and above what you owe for the tax year will be refunded.

In 2016, OSC taxed some wages using the Supplemental Flat Rate, but not others. In 2017, OSC changed the tax withholding methodology to be consistent, ensuring that all non-regular wages be taxed using the Supplemental method.

Regarding the recent Longevity Payments, on March 10, 2017 in Payroll Bulletins 1551 (CSEA) and 1552 (PEF) and at the Payroll Users Group for agency payroll officers on March 2, 2017, OSC notified and emphasized to all State agencies that the Supplemental Flat Rate withholding method will be used.

This change brings the State into compliance with IRS requirements. It is consistent with the practices of other States and Municipalities.

* A CONSTITUTIONAL CONVENTION UPDATE:

If you see the logo “New Yorkers Against Corruption” this is the union’s movement. We can’t use the CSEA logo or any other union logo so this is what the movement to vote no will be called. If you see this logo, know that your union is hard at work getting the message out to vote “NO” to the constitutional convention in an effort to protect our pensions and other rights.

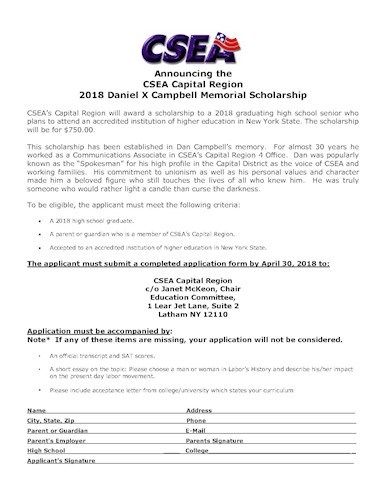

2017 Dan Campbell Memorial Scholarship

2017 – CSEA Local Election Information

Please click on the link above to get all the details and dates regarding the 2017 CSEA Local Elections.

PCO Test Preparation Workshop Date Added

Due to popularity, an additional workshop to prepare for the NYS Professional Career Opportunities (PCO) exam has been added.

Date: Wednesday and Thursday, March 29 and 30, 2017

Location: New York State United Teachers (NYSUT), 800 Troy-Schenectady Road, Latham, NY 12110

Time: 6:00-8:00pm (please arrive by 5:30 on the first night for registration)

Cost: CSEA Members: $15.75 / Non-members: $31.50

Please prepay by March 27th.

YOU MUST PRE-REGISTER FOR THIS WORKSHOP.

Register online at: https://www.csealearningcenter.org/learncenter/wregister.cfm

You can pay with a credit or debit card, but ONLY if you register online.

If you prefer to register by phone, please know that we cannot accept credit cards and you will have to mail in a check or money order.

Call the CSEA WORK Institute at 1-866-478-5548 or (518) 782-4427*

*If you are a CSEA member, we will need your CSEA ID # for the member discounted price. After registration, you will receive information regarding payment.

No refunds will be given unless class is cancelled.

Can’t make it on this date and time? Check out OUR ONLINE TRAINING Courses. TRY A FREE DEMO AT:

CSEA/UNIFIED COURT SYSTEM CONTRACT NEGOTIATIONS UPDATE – find future updates here http://www.cseajudiciary.org/Contract

(Kathy Guild, CSEA Dep. Director of Contract Administration)

CSEA and UCS met on March 1, 2017 and March 2, 2017 for the first round of contract negotiations. The current Collective Bargaining Agreement expires on March 31, 2017. All increments, longevity payments, uniform and equipment allowance payments, health insurance and dental and vision benefits will continue to be paid per the Triborough Amendment until a successor Agreement is agreed to and ratified by the membership.

Both sides exchanged initial proposals and discussed the issues that the CSEA UCS members told us were important to them in the contract survey. It was a productive session and both sides agreed to go back and work on some language to be discussed at the next round.

The next session will be held on March 14, 2017 and March 15, 2017 with additional sessions planned in April and May. We will continue to keep you updated as we go through the negotiations process.

CORRECTION – LONGEVITY PAYMENT/LUMP SUM PAYMENT

UCS has clarified that those eligible for an “end of contract” $750 Lump Sum payment should see that paid out in the April 19th paycheck. Employees on payroll in active status as of March 31, 2017 are eligible for the one-time Lump Sum $750 payment, which is not part of basic salary but is pensionable.

Longevity Payments and those eligible for Increments will see those in the May 3rd paycheck.

EBF CO-PAY REIMBURSEMENT

A reminder to submit your CSEA EBF co-pay reimbursement form by the deadline of March 31st, 2017.

Form can be found at http://www.cseajudiciary.org/Resources/Services

CSEA STATEWIDE “IRVING FLAUMENBAUM” SCHOLARSHIP APPLICATION

Attached is the scholarship application and information for the Flaumenbaum Scholarship program. The application for the Flaumenbaum scholarship will automatically enter the applicant for three different scholarships (see the attached flyer).

Please note the application deadline of April 15th for the Flaumenbaum application.

Compensatory Time Off —— updated 2/27/2017

This is in response to CSEA’s request regarding Section 10.9, Compensatory Time Off, of the 2011-2017collective Agreement between the Civil Service Employees Association, Inc. (“Association”) and the Unified Court System (“State”).

During the triborough period, the State will not end the compensatory time option for hours worked between 35 and 40 hours. We will defer the matter for further discussion at negotiations for a successor agreement to the 2011-2017 Agreement.

Very truly yours,

Lauren DeSole

Subject: Rx Co-Pay assistance

We’ve been hearing some complaints about how difficult it is for UCS employees to get access to CDPHP EoBs so they can properly submit for co-pay reimbursements. I have directed that a tool be developed to help our members. Feel free to share this tool that can be found on our website. The direct address for the tool is www.cseaebf.com/eob It can also be found by going to our EBF website and getting in to the FAQ section. There is a question there that will redirect to this same link. Feel free to share this information with all members and officers.

Bill Howard

Director

CSEA Employee Benefit Fund

1 Lear Jet Lane, Suite 1

Latham, NY 12110

518-782-1500

bhoward@cseaebf.org /// www.cseaebf.com

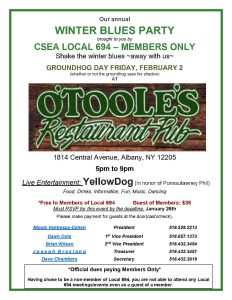

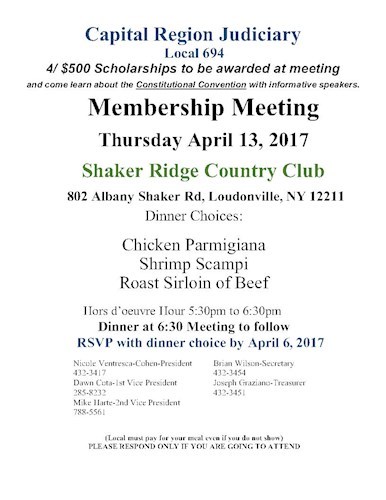

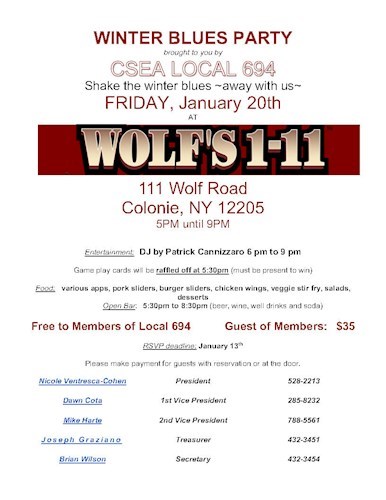

WINTER BLUES PARTY– JANUARY 20TH – RSVP BY JANUARY 13TH

EMPLOYEE BENEFIT FUND CO-PAY REIMBURSEMENT

A reminder to submit your EBF reimbursement form once you have reached a combined co-pay amount of $325 for physician visit and prescription co-pays OR on/after December 31st. Applications are accepted for 2016 reimbursement through March 31st, 2017. See the attached guidelines and pay particular attention to what proof of co-pays are accepted, i.e., Explanation of Benefits (EOB) for Physician co-pays and pharmacy printouts for Prescription co-pays.

RETIREES

On behalf of our Local Executive Board, we wish you well in retirement and remind you to fill out the CSEA Retiree Membership form, to remain a CSEA member in retirement. As a Local we offer to pay the first year of retiree dues. Please contact an officer to apply for this benefit.

FINAL REMINDER – 2017 CONTRACT NEGOTIATIONS SURVEY

COMPLETE BY DEC. 30TH

The 2017 CSEA-UCS Contract Negotiations Survey is now available and can be accessed at the following link:

https://cseany.org/ucs-negotiations. Please complete by survey by December 30th so that the results can be tabulated prior to your Negotiating team meeting in January.

NOTE: The survey is only available to CSEA Judiciary members. You must provide your CSEA Membership ID Number to gain access to the survey. If you need to find your number, go to the CSEA, Inc. web site, www.cseany.org, and obtain your ID number from there (on the Home Page, upper right-hand corner). The survey is short and provides you with an opportunity to be heard regarding our upcoming contract negotiations and what issues are of importance to you. Please spread the word to your co-workers and take the time to complete the survey.

On behalf of your Local 694 Executive Board, we wish you a wonderful holiday and all the best in the New Year!

ATTENTION CSEA LOCAL 694 MEMBERS:

Our current contract expires March 31, 2017

Your negotiation team has already been appointed and will begin working on delivering a fair contract for all of our members. The first step in that process is hearing from you. To that end we are strongly encouraging all CSEA members please go to the CSEA website at https://cseany.org/ucs-negotiations and complete the online survey to tell us what is important to you in the upcoming contract.

You must provide your CSEA Membership ID Number to gain access to the survey. If you need to find your number, go to the CSEA, Inc. web site, www.cseany.org, and obtain your ID number from there (on the Home Page, upper right-hand corner). The survey is short and provides you with an opportunity to be heard regarding our upcoming contract negotiations and what issues are of importance to you. Please spread the word to your co-workers and take the time to complete the survey.

****SURVEYS WILL NO LONGER BE MAILED TO MEMBERS****

If you do not have access to fill out the online survey, please contact me via email or telephone to request your survey be mailed to you.

Your team will work as diligently as possible to obtain a contract you can be proud of.

Thank you in advance for your anticipated cooperation.

Nicole Ventresca-Cohen, President

518-528-2213

ngcb1@yahoo.com or ncohen@nycourts.gov

Your negotiating team:

Kathy Guild, CSEA Deputy Director of Contract Administration

Don Lynskey, chair

Vinnie Martusciello

Nicole Ventresca-Cohen

Bob Pazik

Kevin Mahler

Scott Gartland

Diane Hansen

***************************************************

© 2011-2019 CSEA Judiciary | Created By: dezinsINTERACTIVE